Flat tax

A flat tax to its critics is much more likely to hurt the poor and benefit the rich by taking more of a bite out of low-income folks budgets. We will begin paying ANCHOR.

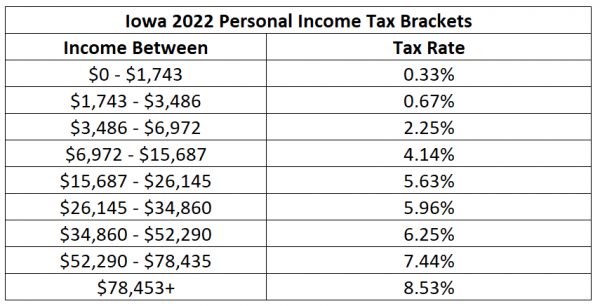

The Grumpy Economist Tax Graph

Property Tax Relief Programs.

. An income tax is referred to as a flat tax when all taxable income is subject to the same tax rate regardless of income level or assets. These candidates tax assessments are then matched. Typically a flat tax applies the same tax rate to all taxpayers with no deductions or exemptions allowed but some politicians have proposed flat tax systems that keep certain deductions in place.

The deadline for filing your ANCHOR benefit application is December 30 2022. House Bill 1 would move Idaho to a flat income tax structure reduce the rate from 6 to 58 percent exclude an additional 2500 single filers or 5000 joint filers from taxation. In this respect a flat tax is a type of consumption tax.

Compare detailed profiles including free consultation options locations contact information awards and education. Flat tax a tax system that applies a single tax rate to all levels of income. Governor Ducey signed the historic tax package into law last year further.

However many flat tax regimes have. Therefore except for the exemptions the economic. A flat tax is levied on income-but only.

With enactment of the flat tax in 94 days on January 1 Arizona will have the lowest flat tax in the nation. In short the flat tax is a consumption tax even though it looks like a wage tax to households and a variant of a VAT to most businesses. Flat rate taxes only one income and that makes it easier to understand and.

Bien que son nom paraisse anglophone la Flat Tax est un impôt français mis en place en 2018 sous le gouvernement Macron. It wouldnt give tax filers a hard time and those at the IRS would welcome the easy computation. 877-696-2109 Law Firm Profile Contact us.

United States Tax Court Bar Member. The difference between a flat tax and a national sales tax is where the tax is collected. La Flat Tax aussi appelée Prélèvement Forfaitaire.

Find top Beverly NJ Tax attorneys near you. Most flat tax systems or. A flat tax system applies the same tax rate to every taxpayer regardless of income bracket.

It has been proposed as a replacement of the federal income tax in the United States which was based on a system of. Properties reflecting a variation with tax assessed being 10 percent or more above the samplings median level will be pinpointed for.

A Flat Tax Is Wrong For Georgia Georgia Budget And Policy Institute

Political Cartoons Dana Summers Feels Like A Flat Tax To Me Washington Times

The New Italian Flat Tax For High Net Worth Foreigners D Andrea Partners Legal Counsel

Illinois Used To Have One Competitive Advantage Over Its Neighbors Its Flat Tax Now That S Largely Gone Madison St Clair Record

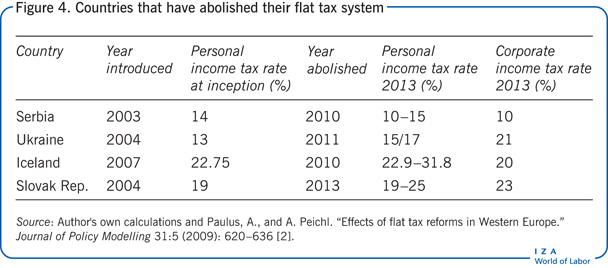

Iza World Of Labor Flat Rate Tax Systems And Their Effect On Labor Markets

Study Shows Illinois Flat Tax System Is Harder On Black Latinx Taxpayers

Arizona S 2 5 Flat Tax Going Into Effect A Year Ahead Of Schedule Phoenix Business Journal

The Flat Tax Revolution Gains Steam John Steele Gordon Commentary Magazine

Would A Flat Tax Be More Fair Youtube

Irs Control Would Be Hampered By The Flat Tax The Daily Hatch

Flat Tax Or Flat Out Dead Reagan Nj Com

Assessing The Perry Flat Tax Tax Foundation

Who Would A Move To A Flat Tax Benefit The Best Off Wisconsin Budget Project

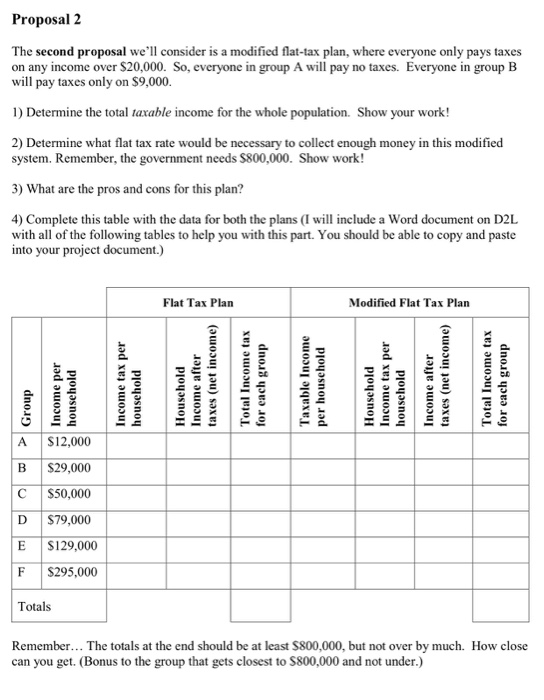

Solved Project 1 Flat Tax Modified Flat Tax And Chegg Com

Most Republicans Back A Flat Tax Yougov

Republican Presidential Candidates Rally Around Flat Tax The New York Times

Worthwhile Canadian Initiative Canada Already Has A Flat Tax